Commercial general liability insurance coverage is one of the most important types of insurance for businesses. It helps protect your company from financial losses due to third-party claims of bodily injury, property damage, and personal and advertising injury. CGL can also provide coverage for certain first-party liabilities. Without CGL insurance, your business would be responsible for paying any damages or legal expenses that result from these types of claims — and that could quickly bankrupt your company. So if you’re not yet much familiar with CGLI, here’s a quick Commercial General Liability Coverage Full Guide.

What Is Commercial General Liability Insurance?

Most small businesses need commercial general liability insurance coverage, but the amount of coverage you need will depend on the size and type of business you have, as well as the products and services you offer. CGL insurance can help protect your business from a variety of third-party liabilities, including:

Bodily injury

Bodily injury is often a covered risk under commercial general liability insurance (CGLI). This means that if an individual is injured as the result of your business, they may be able to file a claim against your insurance policy. This coverage can help pay for medical expenses if someone is injured on your property or as a result of your products or services. It can also cover lost wages if the injured person is unable to work.

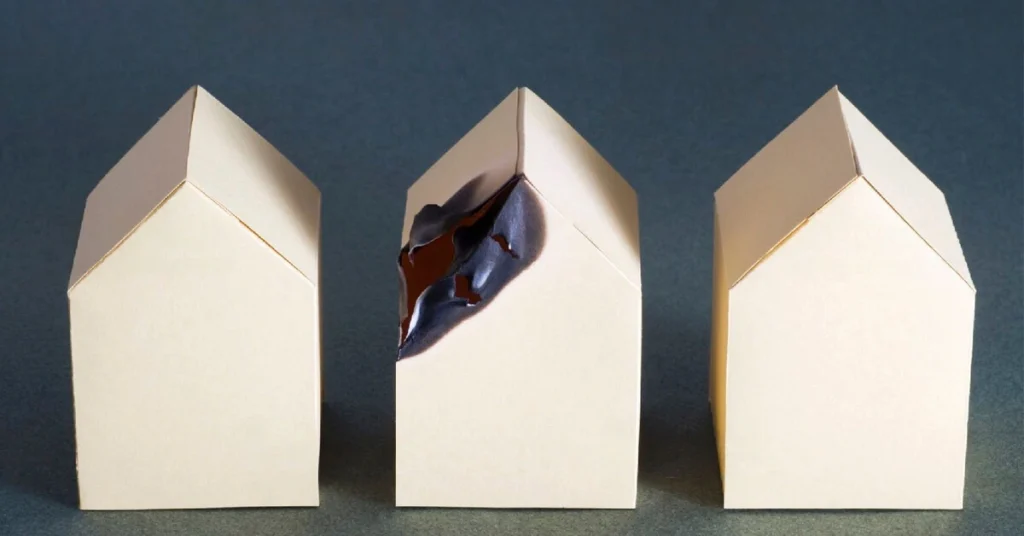

Property damage

In general, property damage is defined as any physical damage to tangible property. This can include damage to both personal and commercial property. Property damage coverage can also help pay to repair or replace the property that is damaged or destroyed as a result of your business operations. In most cases, property damage will be covered under a CGL policy; however, there are some exceptions. It’s important to understand when you are covered for property damage and when you are not.

Personal and advertising injury

This type of coverage includes injury that occurs as a result of an offense that targets an individual or organization’s reputation or good name. Some examples include slander, libel, defamation, and Invasion of Privacy. It’s important to be aware of this exclusion because many times these types of injuries are not covered under workers compensation policies. If you are a business owner, it’s crucial to have Personal and Advertising Injury coverage in your commercial general liability insurance policy to protect yourself from potential lawsuits. This coverage can help protect you from claims of defamation, invasion of privacy, and false advertising.

Understanding Claims-made Versus Occurrence-made Policies

CGL policies can be either claims-made or occurrence-based. A claims-made policy will only cover claims that are made during the policy period. An occurrence policy, on the other hand, will cover any claim that arises from an incident that occurred during the policy period, even if the claim is not filed until after the policy has expired.

For example, let’s say you have a claims-made policy with a two-year policy period. If you have an incident that occurs in year one but doesn’t file a claim until year three, your claim would not be covered because it was not made within the policy period.

If you had an occurrence-based policy, however, your claim would still be covered because the incident occurred during the policy period, even though the claim was not filed until after the policy had expired. Most CGL policies are claims-made, but occurrence-based policies are available from some insurers.