When you own a small business, the primary focus is often on growth and tapping into the customer potential; it’s all about hustling and keeping the lights on. However, most startups overlook one crucial aspect of the business, i.e the need for adequate insurance coverage. Especially the Commercial General Liability Insurance (CGL). In this blog, we are going to discuss the importance, cost, and benefit analysis of CGL for small businesses and how it can protect you from unforeseen liabilities.

Table of Contents

What is Commercial General Liability Insurance (CGL)?

Designed specifically for small businesses, Commercial General Liability provides protection from financial loss due to claims of bodily injury, personal injury, and property damage. It works as a safety net in order to save you from any upcoming lawsuits. Whether it’s a customer falling down a loose step on your front door or a client claiming your product harmed them, CGL saves you from any potential incidents that could destory your image.

Key Components of CGL

Bodily Injury Coverage: Covers any medical expenses and legal costs if someone gets injured on your business site.

Personal injury Coverage: This typically includes protection against claims such as slander, defamation, or invasion of privacy, which can be particularly harmful for businesses in marketing or public relations.

Property Damage Coverage: Covers any type of property damage to others due to your business conduct.

Advertising Injury: Covers protection against your advertising actions like copyright infringement or false advertising.

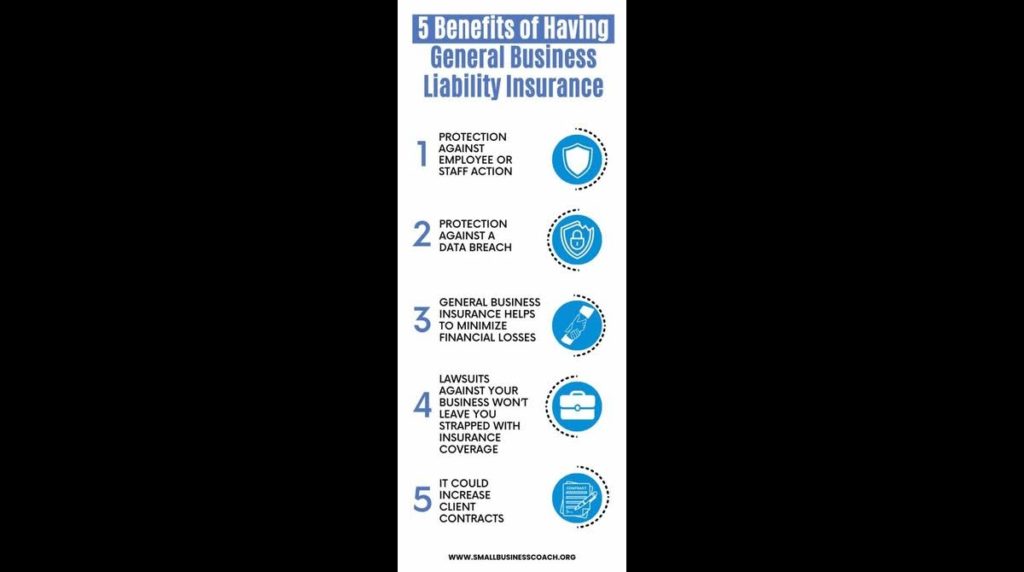

Why is CGL Important for Small Businesses?

Financial Protection: Lawsuits can cost you a fortune. Even if you win, the legal fees can be incredibly costly, especially for a small business. CGL protection helps cover all these expenses, allowing your business to run operations smoothly as always.

Client Credibility: Liability Insurance helps you maintain your credibility. Clients feel more secure knowing you have the right coverage, which ultimately leads to more business.

Contractual Obligations: Most clients or vendors require some sort of proof of liability insurance before partnering up. This is a quiet common practice in businesses such as construction, healthcare, and consulting.

Understanding General Liability Insurance Costs

One of the most common questions for small business owners is, “How much is this going to cost me?” While the cost of Commercial General Liability Insurance can vary significantly depending on numerous factors, it’s generally considered affordable when compared to the anticipated expenses of a lawsuit.

Factors Influencing CGL Costs

- Business Type: Different types of business have varying levels of risk. For instance, a construction business might be willing to pay more than an office-based consulting firm with less collateral damage.

- Business Size: The larger the business, the greater the risk exposure.

- Location: The area where your business is located hugely impacts the coverage prices. Areas with high litigation rates may get higher premiums.

- Policy Limits: The amount of coverage you choose directly affects it’s cost. Higher limits often provide more protection but charge you higher premiums.

- History of Claims: If your business has a higher record of claims in the past, you may face higher premiums as insurers base your future risk on prediction and forecasting.

Average Costs

On average, small business owners can expect to pay between $400 and $1500 annually for General Liability insurance. However, your specific costs may vary based on the factors discussed above. Therefore, it’s necessary to shop around and get multiple quotes from different insurers to find the right coverage for your business without shelling out a fortune.

Common Misconceptions about General Liability Insurance

Most businesses make this mistake of underestimating the importance of CGL. Others believe it’s only relevant for large businesses. One prevalent belief is that they are automatically covered under homeowner’s insurance, which is not at all the case for commercial business operations. By addressing these misconceptions, we can diminish the stigma around Insurance coverage and help small business owners make an informed decision.

“My Business is too small for insurance.”

Believing that you require insurance only if you operate on a large scale is absurd. Accidents can happen to any business of size, and the financial impact can be devastating.

“My Business is already covered by homeowner’s insurance.”

While homeowner’s insurance does protect you against some business-related activities, it doesn’t cover commercial liability. And that is why it’s necessary to cover your business’s unique needs in all aspects.

“Liability Insurance is too costly.”

While costs for liability insurance vary, insurers can offer you more flexible plans based on your budget. In this case, it’s always better to be safe than sorry, as the potential costs of a lawsuit can lead to bankruptcy or shutting down your business.

How to Choose the Right General Liability Insurance

Choosing the right policy plan for your business can be exhausting. So let’s break it down into small, attainable steps for a unique yet informed approach towards making the right decision.

Assess your Risks

Before diving into the pool of options on the best or cheapest one available, assess the unique risk factors specifically faced by your business. Such as:

- The nature of your business and customer interaction. The higher the interaction, the higher the risk of injury.

- If you operate out of a physical environment that has a lot of heavy machinery, it’s important to think about the safety of that space.

- If you have a product- or service-oriented business, then consider the potential harm associated with it’s use.

Determine Coverage Needs

Once you’ve evaluated all your risk factors, determine how much coverage you need. First and foremost, consult with an insurance broker or an adviser to help navigate your options based on sufficient coverage and affordability.

Compare Quotes

Don’t opt for the first company you visit or research. Get multiple offers from different insurers and compare the data based not only on the costs but the coverage details as well. Make sure to look for any exclusions or limitations mentioned in the policy.

Read Reviews and Get Recommendations

Insurance companies with a good reputation will have at least a 4.8 to 5.0 rating along with service reviews from existing customers. The best approach is to seek recommendations from other small business owners for a more trusted opinion. A reliable insurance provider can make all the difference!

Final Thoughts

In conclusion, the risks when running a business are very real, and having the right insurance coverage can protect you from financial ruin. In conclusion, CGL is not just a luxury for small businesses; it’s a necessity.